Retail Operating System

Save Hundreds of Hours. Eliminate Errors.

Multi-channel merchants and wholesalers turn to Brightpearl to streamline operations, boost efficiency and stay ahead in a fast-changing retail landscape.

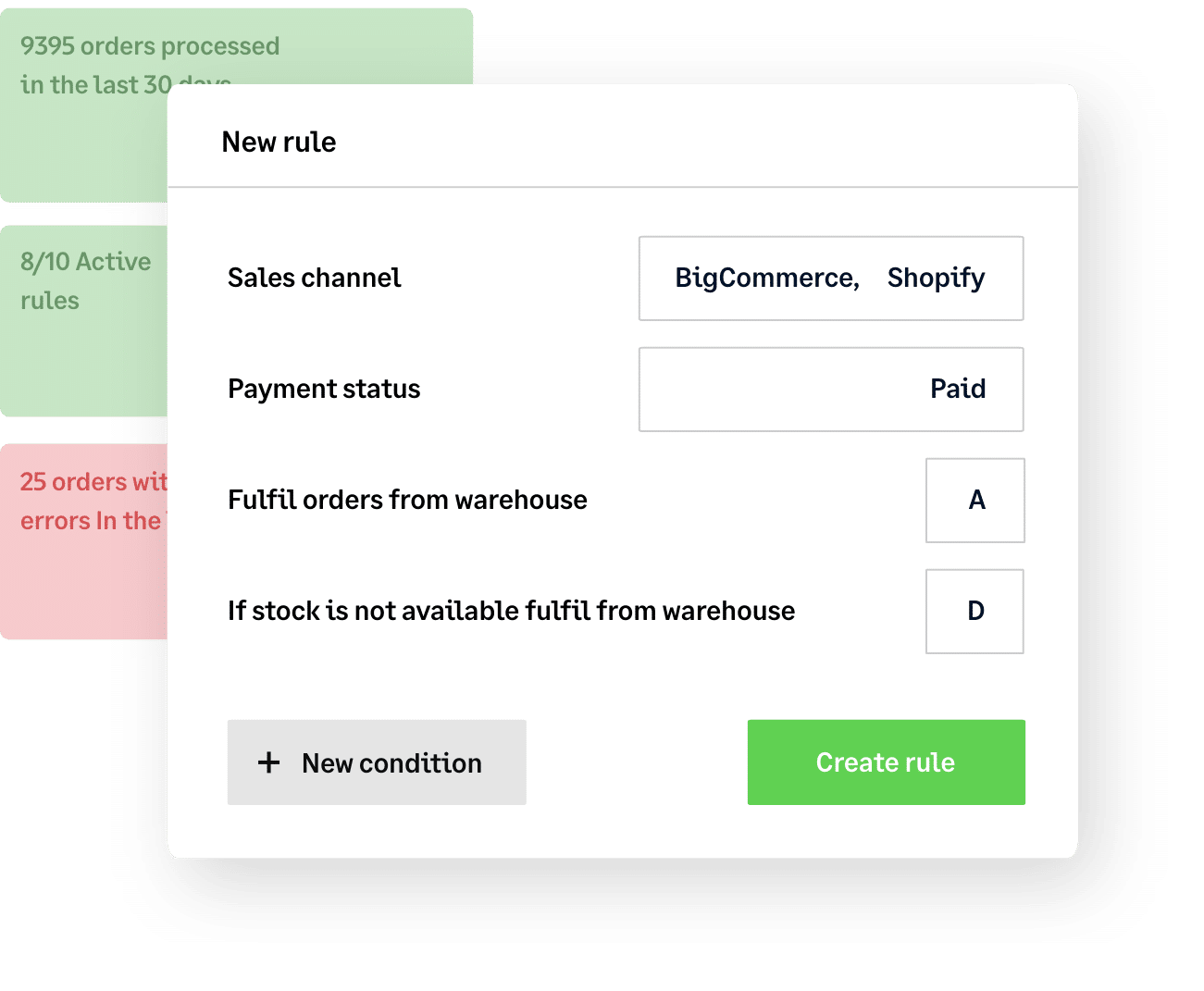

Brightpearl customers are free to focus on growth. They use our Automation Engine to…

- Save two months a year, on average

- Reduce human errors by 65%

- Lower labor costs by 50%

5,000+ pioneering brands rely on Brightpearl to grow further and faster

Tough times don’t last.

Brightpearl customers do.

A global market slowdown. A supply chain crisis. Wavering consumer demand. Rising costs. It’s a tricky time to be in retail. But it doesn’t have to be.

Out of the chaos, opportunities are emerging. Be ready to seize them with Brightpearl.

Automate your operations, intelligently plan your inventory and make your investments go further with our #1 Retail Operating System.

Free up your time, keep up your profits

by automating (almost) everything

Right now, your business needs you to spend your time innovating, adapting and seizing opportunities – not getting bogged down by tedious, low-profit tasks.

Easily automate everything from complex order fulfillment and multi-location inventory management to shipping and accounting with Brightpearl’s powerful Automation Engine. Save 1000s of hours and focus your energy where it counts.

Dodge supply chain

curveballs

with smart sales forecasting and inventory planning

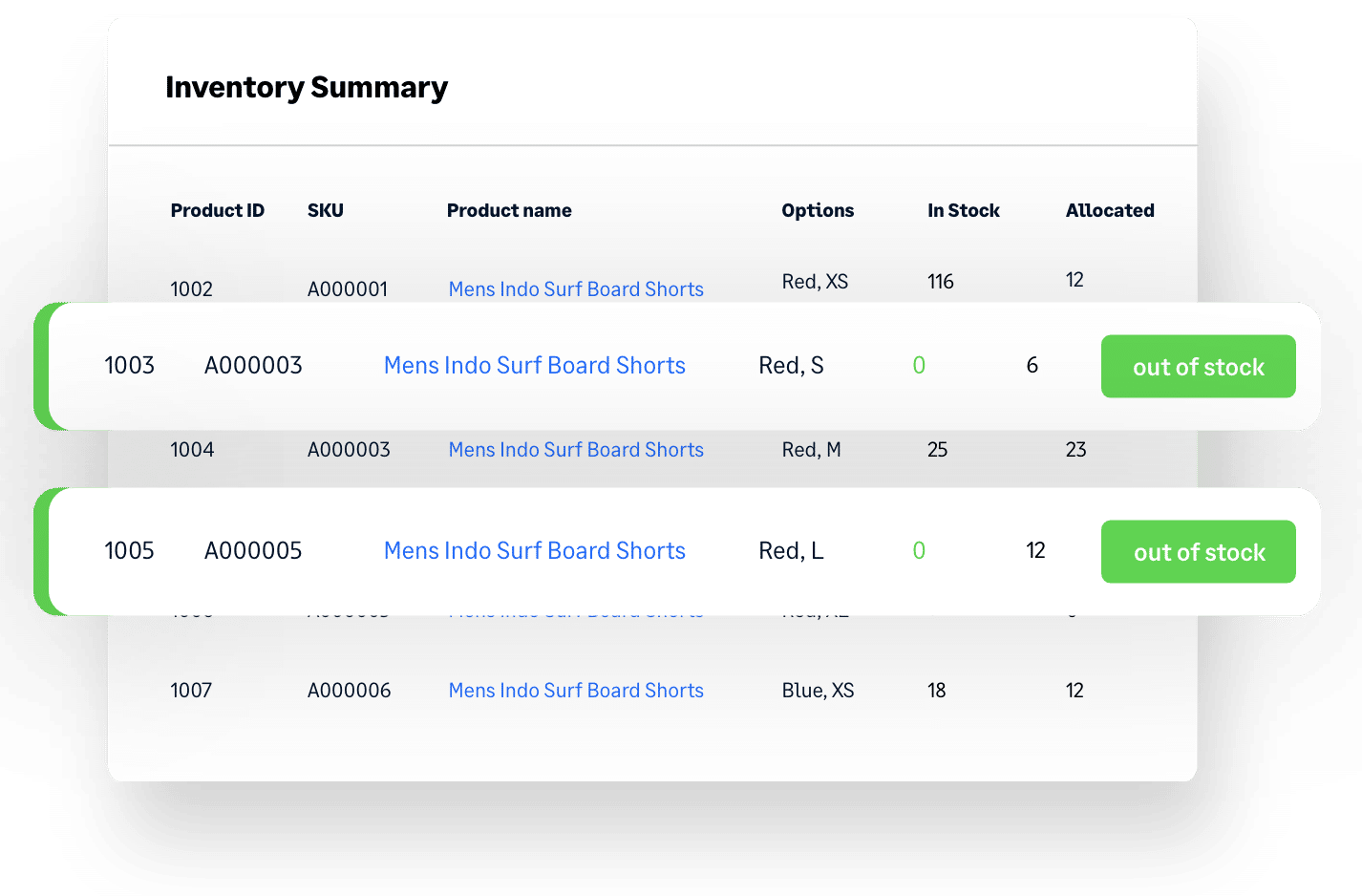

Delayed orders? Warehouse full of stock you can’t shift? Best-sellers always running low? You need an advanced inventory planning solution that can handle unpredictable demand and supply chain disruption to keep your cash flow healthy. You need Brightpearl.

Get buying recommendations based on accurate sales forecasting so you always know what to order, how much to order and when to order it. You can even factor in rapidly-changing trends and sudden market shifts into your planning – in the current market, it’s the only way to get ahead.

Get more bang

for your buck

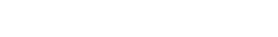

with advanced insights + analysis

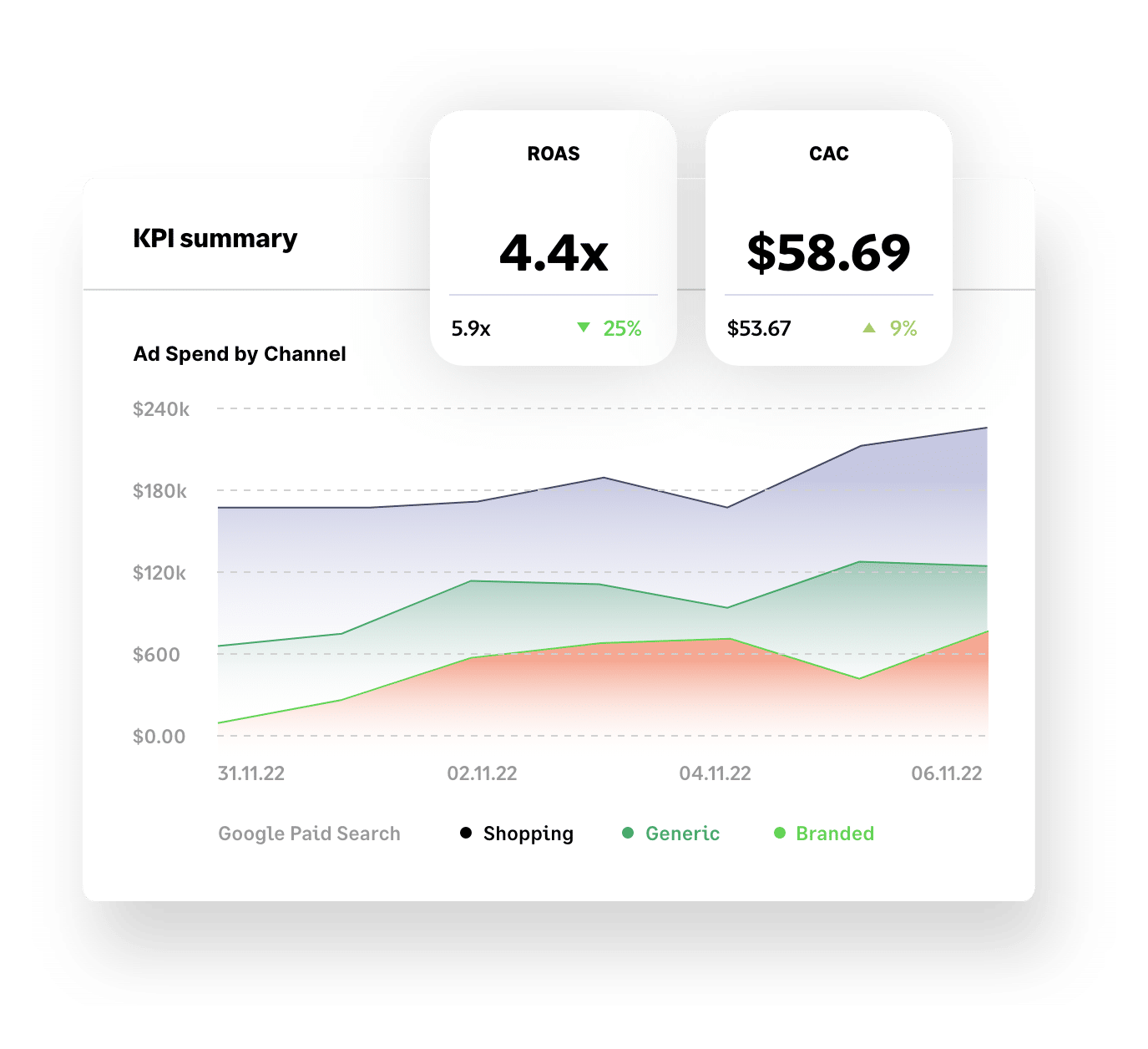

Make smarter decisions and grow your business faster with Brightpearl’s retail analytics.

Yes, our business intelligence tools include key KPIs like Customer Acquisition Cost (CAC), Lifetime Value (LTV), best-selling products and paid search and social performance – but, unlike other tools, our data is accurate and super easy to navigate.

You can even access industry benchmarks to see how your performance compares to your competition.

Be where your

customers are

with a huge range of Plug & Play apps

Attracting new customers (and being where your current ones hang out online) is key to growth but can introduce complexity. Brightpearl’s market-disrupting library of Plug & Play integrations makes it simple.

Add new sales channels – including TikTok, Instagram, live stream platforms and more – in minutes. Curate an ever-changing roster of the latest tech tools, as and when your business needs them. Access deep APIs and a certified network of development partners so that where other brands falter, you can soar.

Expert support

at every step

with our end-to-end services

The right software is important, but it’s not enough on its own. To unlock your unique growth potential, it has to be optimized by experts and backed up by training and support.

At Brightpearl, our retail experts are with you every step of the way. From flawless implementation with a proven 97% success rate and bespoke onboarding training to ongoing consulting and 24/7 support, we’ll ensure you get the very best from Brightpearl.

Our customers

Trusted by merchants

in every industry

Why Brightpearl

Cutting-edge software

Leading tech backed up with a 97% implementation success rate

Part of Sage Group Plc

We're built on a solid foundation, which helps us invest in product R&D

Certified Shopify Partner

We’re proud to be founding member of Shopify’s global ERP Program

Proven track record

We power millions of orders a month for some of the world’s biggest brands

Excellent reviews

We’ve earned great reviews from customers, including 4.5 stars on Trustpilot

Expert support

Our experts are always on hand for training and support

Brightpearl App Store

Instantly connect Brightpearl with the tools you need

to grow fearlessly

Shopify

E-Commerce

Amazon

E-Commerce

BigCommerce

E-Commerce

Magento

E-Commerce

eBay

E-Commerce

Quickbooks

Accounting

Lightspeed

E-Commerce

Shipstation

Shipping

Dotdigital

E-Commerce

Xero

Accounting

Square

E-Commerce

Klaviyo

E-Commerce

More reading

Events, News and Insights

Got questions

Ready to reach your potential? Book a demo today to see how Brightpearl can help you do business better.

Book a demo