Having a strong inventory system is essential for any business. It lets you know what needs re-ordering and when. It tells you how much stock you have left of a particular item and how well it is selling. It also keeps stock moving and prevents it from sitting in the warehouse gathering dust.

But you also need to know how much money your stock is making. It’s not just important for your own bookkeeping – it’s important for tax purposes too.

There are two methods of tracking stock and figuring out profit. These are known as LIFO and FIFO. These acronyms may sound like a couple of kid’s TV characters, but actually, they’re great ways of calculating the unit costs of goods that have been sold.

The LIFO definition stands for last in, first out. As such, it presumes that the most recent products in a company’s inventory gets sold first. It then uses these production costs. Whilst the FIFO definition means first in, first out. In this case, the oldest products in the inventory have been sold first. Therefore, this is how production costs are calculated.

What’s the Difference in Methods?

The first obvious difference is that they are opposite in the how they view the flow of inventory, and how they’re carried out. What kind of business you run will make a difference to the type of method that works best for you.

For example, if you sell computers, then the FIFO method would work best, as you don’t want the old stock to sit there and fall into obsolescence. While if you sell fresh cakes, the LIFO method would work better. As you want that fresh produce to go to market before it goes bad.

Otherwise, depending on your product, you can figure out if the FIFO or LIFO method is best for you. Choosing the right method will help maximize profit.

As the methods go off inventory totals, both ways must assume that stock is being sold as intended orders. This helps calculate the cost of goods sold (COGS).

What is the FIFO Process?

It’s simple to use FIFO – the first in, first out method means just that. The oldest inventory items are always the first to go. So, old stock isn’t left hanging around. Whether you’re running an e-commerce site or a bricks and mortar company, the outcome is the same. It basically means that whatever is at the front of the queue goes first. Products leave the warehouse in the order in which they arrived.

Stocktake, net income and profit are processed and calculated based on this way of selling. This affects your inventory accounting and the tax you pay.

This type of stock calculation is the most used method. It means you’re more likely to use the actual price you paid for the products and/or raw materials. It’s an easier method to get to grips with and to put in place. And it also means that money is not lost on your stock. As the FIFO method of inventory requires more of a natural flow, fewer mistakes are likely to happen. Especially when it comes to adding it all up at the end of the accounting period.

You may be asking how to do FIFO and LIFO? There is a way to figure out the COGS when looking your first in, first out balance sheet. You work out the cost of your oldest inventory and multiply that by the number of inventory you sold.

To calculate COGS using the LIFO method, you need to focus on the cost of your most recent inventory. Then multiply that by the amount of inventory sold. We will look in more detail at LIFO later.

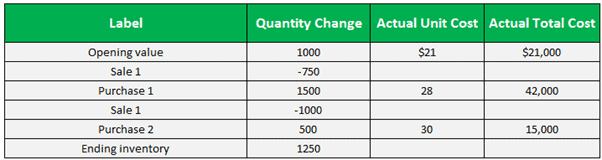

The following image from Wall Street Mojo is a great example of how FIFO works:

FIFO Accounting

When it comes to inventory accounting, there is a difference in the result of FIFO and LIFO. The method of inventory management you choose will impact your financial results and tax payments. Here is what to take into consideration when looking at first in, first out accounting:

- It’s good for record-keeping. – Because the oldest layers are used up on a constant basis, record-keeping is reduced. It’s easier to keep an eye on your inventory value, as well as your predicted gross profit. There are lots of inventory management systems that can help with record keeping. But, due to the natural turn over of items, FIFO is a much smoother process for record-keeping.

- Inflation will affect your tax. – This can work in your favor as the initial cost of inventory will be lower, whilst the selling price will be higher. However, it may also mean that you are buying new items at a higher price. Which can mean loss of profit. You may also have to pay a higher rate of tax.

- Deflation means you are paying less for stock. – A decrease in sales means that you end up with a lower profit for the first item you buy. However, it may mean that you end up paying less for stock and making more profit, too. You may also end up paying a lower rate of tax.

- Flow of goods makes this an easy method. – The cycle of buying and selling stock makes the FIFO accounting method a much easier way to keep on top of things. As well as making it much simpler to calculate the COGS.

- There are no restrictions on financial reporting. – The FIFO method means there are no generally accepted accounting principles (GAAP) or international financial reporting standard (IFRS) restrictions in financial reporting.

- There isn’t as much fluctuation. – In using a FIFO method, costs of goods tend to stay the same. It’s simple to keep track of your overall inventory balance, as well as make cost flow assumptions. Obviously, there may be times when prices change, such as with inflation and deflation. In general, though, the inventory layers reflect recent pricing.

Pros and Cons

FIFO is more likely to give accurate results. This is because calculating profit from stock is more straightforward, meaning your financial statements are easy to update, as well as saving both time and money.

It also means that old stock does not get re-counted or left for so long it becomes unusable. Resulting in the loss of profit and wasted goods.

In using the FIFO method, inflation is also covered. That’s because you are buying products as the economy changes.

There are some bad points to the FIFO method, too. One of these being making more profit using this method also results in a higher amount of tax needing to be paid.

Also, because a high amount of data is required to extract the cost of goods, clerical errors may occur. When balancing your beginning inventory and ending inventory, FIFIO can confuse profit results due to change in economic periods.

What Is The LIFO Process?

Let’s now look at the LIFO method. What is LIFO? The last in, first out method assumes that the last placed item will be the first sold. It shouldn’t be confused with the first in, last out method.

Think of it like going to see a gig. Those that get in first go to the end of the venue, and those that are in last end up next to the door. So, when the gig is over, those that went in last are the first out.

Now compare this to stock. With this method of inventory management, the oldest stock goes to the back, whilst the newest stock is the first to be purchased.

It is the opposite of FIFO. It focuses on the product that you make a sale with. Even when old stock, that you may have paid a different price for, is still on the shelf. It’s a great method to use when stock is always changing costs, or if you have perishable goods coming in.

This is because it matches the latest costs of products. However, when stock is looking old or needs shifting, it can be hard to use the LIFO method to calculate profit. For yourself, or for tax purposes.

The way that costs are calculated using this method has already been discussed. But as a reminder, COGS for LIFO are calculated by multiplying the cost amount by inventory sold.

No matter what the method, fluctuations in prices must be taken into consideration.

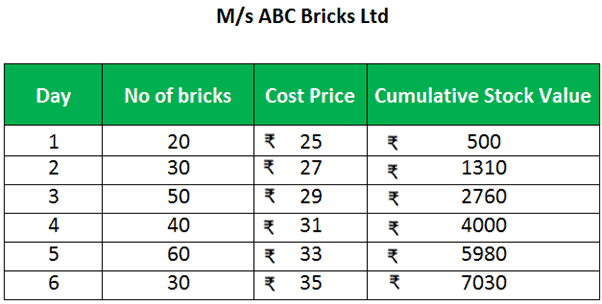

Wall Street Mojo again have a great example of how the LIFO method works:

LIFO Accounting

When looking at FIFO vs LIFO accounting, there are many differences between the two. This is because there is a variation of the stock accounted for and a fluctuation in the price paid for an item.

Here are some points to consider when looking at how to manage LIFO accounting:

- Record keeping can be complicated. – Due to the inventory layers in the LIFO system, this method can make record-keeping confusing. This is because the flow of inventory means old layers and stock can stay in the system for a long time.

- Inflation may affect old stock. – If the price of products is going up, your old stock will make a bigger profit. However, it means that you will also be buying the stock at a raised price. That means you could end up with a loss if you aren’t selling straight away. Less profit does mean less tax, though.

- Deflation may mean less profit. – If everything is based on the last item sold, then you will not be getting as much gross profit on this item. However, if you buy an item for cheap and manage to sell it on at a higher rate, then you will be making more profit. Which in turn means you will have to pay a higher amount of tax.

- This isn’t a very natural method.– Most businesses tend not to leave the old stock lying dormant. Meaning it doesn’t have a natural lifecycle of product movement. Places like supermarkets tend to use LIFO due to fluctuation and rising costs.

Despite supermarkets selling perishable goods, they also have a high turn-over of stock. This makes this problem a bit easier. They can, for instance, reduce produce that is going off quickly. If you are not a business who is able to do this, this may not be a method for you.

- There are restrictions with financial reporting. – The IRS says that LIFO can be used, but it must be used for all levels of the reporting entity if you use it as a subsidiary. IFRS does not allow for this method at all. GAAP does accept the LIFO method.

- Inventory layers make fluctuation reporting complex. – Inventory layers can stay in the system for a long time. Average costs vary, and reporting can be confusing. Changing one of these layers at any point can make the results of items sold increase or decrease.

LIFO Pros and Cons

LIFO is beneficial for those wanting to keep tax costs down. It can work well for retail firms who want to work with trends and quickly sell items that are in fashion now. Or for places like supermarkets who want to deal with the fluctuating prices of food.

This method also has its negative points. One of these being that although you may be paying less tax, you will also have to record a lower profit. Also, the fluctuation of prices means that keeping on top of your inventory value and all the layers can be complicated. Making it hard to keep on top of profit and tax payments.

Is LIFO better than FIFO? With a few exceptions, the short answer is no. But that’s not to say that with an extra bit of research and time invested, it won’t work for you. It completely depends on what kind of business you run.

There is technology that can help with managing both FIFO and LIFO. Helping you to make accurate inventory tracking calculations.

After looking at the FIFO and LIFO difference, both methods have pros and cons. FIFO focuses on using up old stock first, whilst LIFO uses the newest stock available. LIFO helps keep tax payments down, but FIFO is much less complicated and easier to work with.

However, it is all down to the company you own as to what method you choose.

As the economy changes over time, you will learn how to optimize sales and sell at the most profitable rate. But for now, learning how to work with either a FIFO or LIFO method will enable you to calculate profit more easily. And know how much tax to pay.